43+ do you get mortgage interest back in taxes

To do this sign into TurboTax and click Deductions Credits Search for PMI search button on top right of screen and click the Jump to. The terms of the loan are the same as for other 20-year loans offered in your area.

Upad Mortgage Interest Relief Calculator How Much More Tax Will You Be Paying

Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Web Open your return. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

For example if you pay. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. 25900 for married couples filing jointly.

Compare Get The Lowest Rates. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web The amount you can deduct does not change depending on your income tax bracket but the amount of money you will save on your taxes does change. Ad Best Online Mortgage Rates From Top Lenders.

You paid 4800 in. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Paying mortgage interest does not provide any additional tax savings unless the amount of interest paid during the year is higher than the standard deduction.

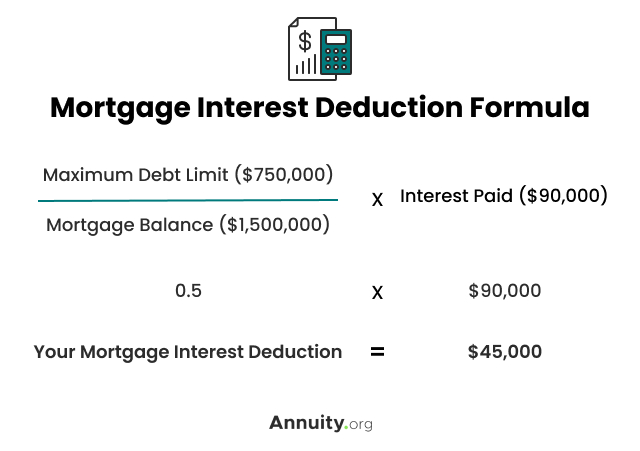

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web You can deduct interest on up to 1 million in mortgage debt. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. Web The standard deduction for the 2022 tax year is.

Apply Online Now Get Free Quotes. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. For taxpayers who use.

Web Household income of 63404 per year the median household income in Kansas City Started making mortgage payments in May 2019 on their 189000 home. 12950 for single filers and married individuals filing separately. The Search For The Best Refinance Lender Ends Today.

Since you may be. Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web The mortgage interest deduction allows you to reduce your taxable income by the amount of money youve paid in mortgage interest during the year.

If you have 600000 on your vacation home and 500000 on your primary home the interest on the 100000. Web Basic income information including amounts of your income.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Interest Tax Deduction Smartasset Com

Buy Galaxy S22 Ultra 128gb Unlocked Phones Samsung Us

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

43 Sample Loan Agreements In Pdf Ms Word Excel

Mortgage Interest Tax Deduction What Is It How Is It Used

Bethesda Magazine November December 2022 Digital Edition By Moco360 Issuu

Mortgage Interest Tax Deduction What You Need To Know

Expat Mortgages In The Netherlands Buy A House Hanno

About Tax Deductions For A Mortgage Turbotax Tax Tips Videos

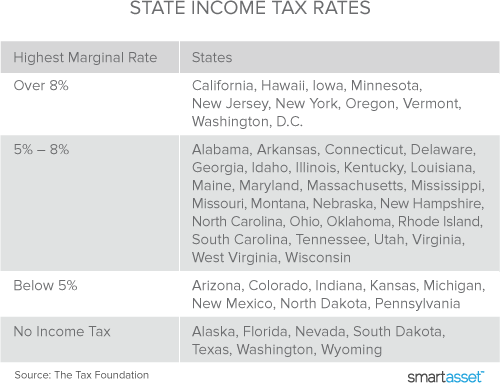

Which States Benefit Most From The Home Mortgage Interest Deduction

Do You Get All Your Interest On Your Mortgage Back On Taxes

Expat Mortgages In The Netherlands Buy A House Hanno

Costly Reversals Of Bad Policies The Case Of The Mortgage Interest Deduction Sciencedirect

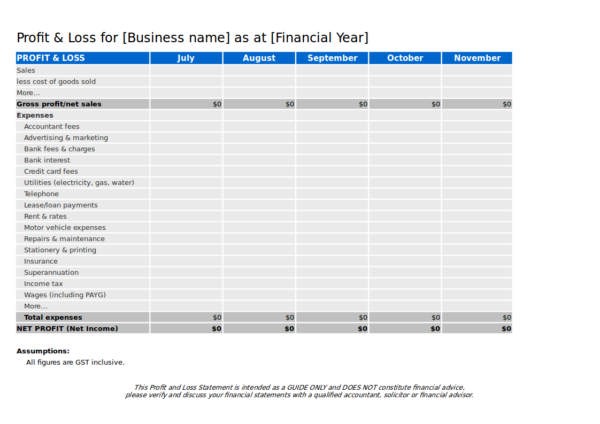

Free 7 Financial Spreadsheet Templates In Pdf Excel

Mortgage Interest Deduction A Guide Rocket Mortgage